Finance Industry Insights

Navigate the evolving landscape of European financial markets through data-driven analysis and expert perspectives

The Digital Banking Revolution Accelerates

European financial institutions are experiencing their most significant transformation since the introduction of the euro. The shift toward digital-first banking models isn't just changing how customers interact with their money—it's fundamentally restructuring the entire industry ecosystem.

What started as a response to pandemic-driven changes has evolved into a permanent restructuring of financial services. Traditional banks are investing billions in technology infrastructure, while fintech startups are maturing into full-service providers.

The most interesting development? Collaborative models between established institutions and innovative startups are creating hybrid solutions that combine regulatory expertise with technological agility. This partnership approach is proving more successful than the initial disruption-focused strategies we saw in the early 2020s.

Regulatory Harmonization

The European Banking Authority finalizes cross-border payment regulations, creating a unified framework that reduces compliance costs by an estimated 30% for multi-national operations. This standardization particularly benefits mid-sized financial firms operating across multiple EU markets.

AI Integration Matures

Machine learning algorithms become standard for risk assessment and fraud detection across European banks. The focus shifts from basic automation to sophisticated predictive analytics that can identify market opportunities and potential risks weeks in advance.

Sustainable Finance Dominance

ESG considerations become mandatory components of all major financial products. Green bonds and sustainable investment vehicles represent over 60% of new financial products launched, driven by both regulatory requirements and genuine market demand.

Key Market Developments

Critical events and regulatory changes that shaped the current financial landscape

Open Banking 3.0 Launch

Enhanced data sharing protocols allow customers to connect multiple financial services seamlessly. This development particularly impacted smaller banks, who gained access to previously exclusive technological capabilities through API partnerships.

Digital Euro Pilot Programs

Selected European cities begin testing central bank digital currency implementations. Early results show promising adoption rates among younger demographics, though concerns about privacy and monetary policy implications remain active discussion points.

Cross-Border Payment Simplification

New EU regulations reduce international transfer times to under 10 seconds for amounts below €10,000. This change primarily benefits small businesses and freelancers who frequently work across European borders, reducing transaction costs significantly.

Fintech Consolidation Wave

Larger financial institutions acquire successful fintech companies, creating integrated service offerings. Rather than eliminating innovation, these acquisitions appear to be accelerating the development of new financial products and services.

The financial sector's evolution reminds me of the early internet days—everyone knew change was coming, but the actual applications surprised even industry experts.

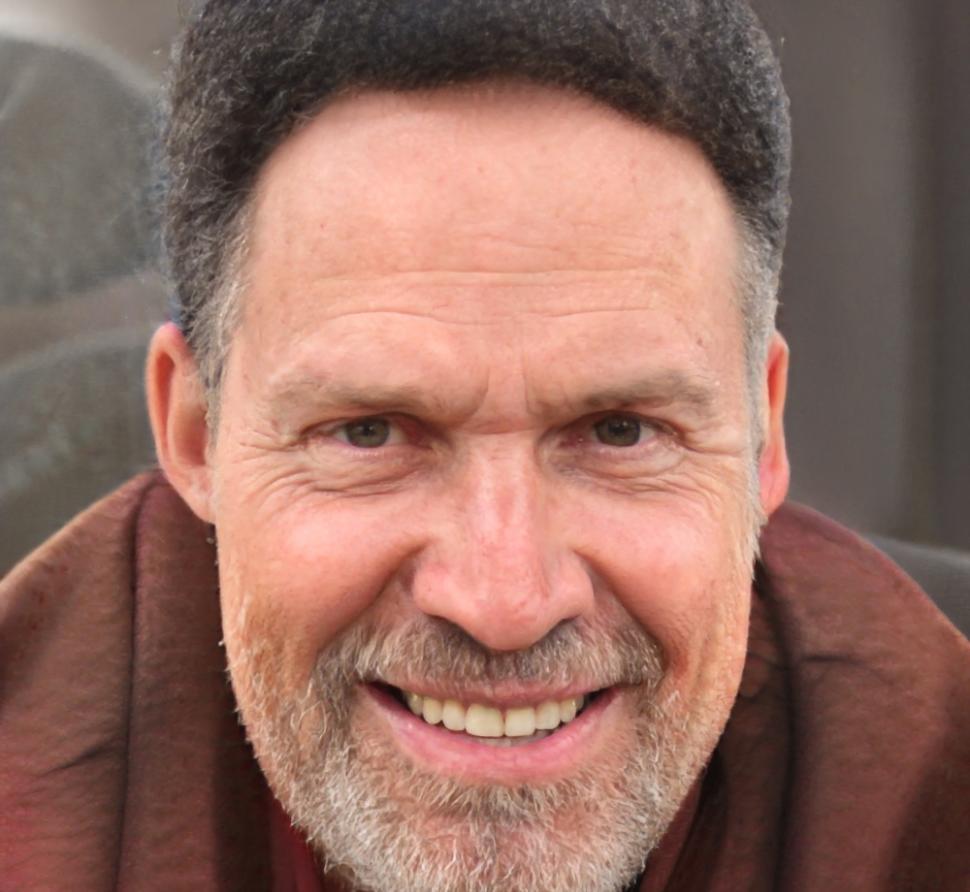

Dr. Tobias Reichmann

Senior Financial Market Analyst

With over 15 years analyzing European financial markets, Dr. Reichmann has witnessed three major economic cycles and their impact on banking innovation. His research on regulatory adaptation has influenced policy discussions across multiple EU financial authorities. He currently focuses on the intersection of traditional banking and emerging technologies, particularly how established institutions can maintain stability while embracing innovation.